-

[세계미래보고서2024-2034] 책소개] 박영숙 제롬글렌 공저. 10년이상 베스트셀러, 모든 산업을 지배할 인공일반지능이 온다[세게미래보고서2024-2034] 책소개 우리는 암과 치매와 고혈압 등 각종 불치병을 치료하고 환경 문제를 해결하며, 새로운 에너지를 확보하고 우주로 진출할 수 있게 만들어줄 가능성이 큰 인공일반지...

[세계미래보고서2024-2034] 책소개] 박영숙 제롬글렌 공저. 10년이상 베스트셀러, 모든 산업을 지배할 인공일반지능이 온다[세게미래보고서2024-2034] 책소개 우리는 암과 치매와 고혈압 등 각종 불치병을 치료하고 환경 문제를 해결하며, 새로운 에너지를 확보하고 우주로 진출할 수 있게 만들어줄 가능성이 큰 인공일반지...

-

기후변화 정보 웹사이트, 기후변화 대안 기술을 가장 잘 알려주는 웹사이트등은 어떤 것들이 있나?기후변화에 관한 상황정리, 기후변화 대안 기술을 가장 잘 알려주는 웹사이트등은 어떤 것들이 있나? 기후변화는 현대 사회가 직면한 가장 중대한 도전 중 하나로, 전 세계적으로 이에 대한 인식이...

기후변화 정보 웹사이트, 기후변화 대안 기술을 가장 잘 알려주는 웹사이트등은 어떤 것들이 있나?기후변화에 관한 상황정리, 기후변화 대안 기술을 가장 잘 알려주는 웹사이트등은 어떤 것들이 있나? 기후변화는 현대 사회가 직면한 가장 중대한 도전 중 하나로, 전 세계적으로 이에 대한 인식이...

-

(사)유엔미래포럼 즉 MP 한국지부관련 창립, 연혁, 장관 등 자료(사)유엔미래포럼이란? (사)유엔미래포럼은 1988년 유엔사무총장이 2000년 즉 새천년이 되어도 지구촌은 남아 있을까? 즉 미래예측을 통한 21세기의 문제점은 무엇인지 보고서 프로젝트를 맡아서 ...

(사)유엔미래포럼 즉 MP 한국지부관련 창립, 연혁, 장관 등 자료(사)유엔미래포럼이란? (사)유엔미래포럼은 1988년 유엔사무총장이 2000년 즉 새천년이 되어도 지구촌은 남아 있을까? 즉 미래예측을 통한 21세기의 문제점은 무엇인지 보고서 프로젝트를 맡아서 ...

-

[검색 엔진을 넘어서: LLM 기반 웹 브라우징 에이전트의 부상] 웹 브라우징 에이전트는 전통적으로 키워드 검색을 통한 정보 검색에 사용되었다. 그러나 LLM의 통합으로 이러한 에이전트는 고급 언어 이해 및 텍스트 생성 능력을 갖춘 대화 동반자로 진화하고 있다.최근 몇 년 동안 자연어 처리(NLP)는 OpenAI의 GPT-3 및 Google의 BERT와 같은 LLM(대형 언어 모델)의 출현으로 중추적인 변화를 겪었다. 많은 수의 매개변수와 광범위한 텍스트 말뭉치에 대한 교육을 특...

[검색 엔진을 넘어서: LLM 기반 웹 브라우징 에이전트의 부상] 웹 브라우징 에이전트는 전통적으로 키워드 검색을 통한 정보 검색에 사용되었다. 그러나 LLM의 통합으로 이러한 에이전트는 고급 언어 이해 및 텍스트 생성 능력을 갖춘 대화 동반자로 진화하고 있다.최근 몇 년 동안 자연어 처리(NLP)는 OpenAI의 GPT-3 및 Google의 BERT와 같은 LLM(대형 언어 모델)의 출현으로 중추적인 변화를 겪었다. 많은 수의 매개변수와 광범위한 텍스트 말뭉치에 대한 교육을 특...

-

[인공지능: 마음 읽기의 미래] 지난 몇 년 동안 AI 개발은 겉보기에 극복할 수 없을 것 같은 장애물을 뛰어넘는 경향을 보여왔다. 따라서 AI 기반 마음 읽기의 가능성을 완전히 배제하는 것은 현명하지 않다. 그러나 우리 정신 생활의 복잡성과 뇌에 대해 우리가 아는 바가 거의 없다는 점을 고려할 때(결국 신경 과학은 아직 초기 단계에 있음) AI 기반 마음 읽기에 대한 확실한 예측은 소금 한 알씩 받아들여야 한다.올해 초 뉴럴링크(Neuralink)는 어깨 아래가 마비된 29세 미국 남성 놀랜드 아보(Noland Arbaugh)의 뇌 내부에 칩을 이식했다. 이 칩을 사용하면 아보가 마우스 포인터가 움직이는 것을 상상하는 것만으로...

[인공지능: 마음 읽기의 미래] 지난 몇 년 동안 AI 개발은 겉보기에 극복할 수 없을 것 같은 장애물을 뛰어넘는 경향을 보여왔다. 따라서 AI 기반 마음 읽기의 가능성을 완전히 배제하는 것은 현명하지 않다. 그러나 우리 정신 생활의 복잡성과 뇌에 대해 우리가 아는 바가 거의 없다는 점을 고려할 때(결국 신경 과학은 아직 초기 단계에 있음) AI 기반 마음 읽기에 대한 확실한 예측은 소금 한 알씩 받아들여야 한다.올해 초 뉴럴링크(Neuralink)는 어깨 아래가 마비된 29세 미국 남성 놀랜드 아보(Noland Arbaugh)의 뇌 내부에 칩을 이식했다. 이 칩을 사용하면 아보가 마우스 포인터가 움직이는 것을 상상하는 것만으로...

-

[AI 일자리 위기, 다음은 CEO 차례다] 인공지능이 일반 직원을 일자리 위기에 빠뜨리고 있는 가운데기업들의 주요 사안의 결정권자인 CEO들이 ChatGPT를 사용하여 얻은 데이터와 정보를 기반으로 비밀리에 중요한 비즈니스 결정을 내리고 있다. 그들이 기술로 무엇을 결정하고 무엇을 하는지 잘 지켜봐야 한다. 비즈니스 역류많은 CEO가 인간 직원을 AI로 대체한다는 아이디어에 기뻐하면서 일부 CEO는 이제 자신도 도마 위에 서게 될 수 있다는 것을 두려워하기 시작했다.미국, 영국, 네덜란드의 수백 명의...

[AI 일자리 위기, 다음은 CEO 차례다] 인공지능이 일반 직원을 일자리 위기에 빠뜨리고 있는 가운데기업들의 주요 사안의 결정권자인 CEO들이 ChatGPT를 사용하여 얻은 데이터와 정보를 기반으로 비밀리에 중요한 비즈니스 결정을 내리고 있다. 그들이 기술로 무엇을 결정하고 무엇을 하는지 잘 지켜봐야 한다. 비즈니스 역류많은 CEO가 인간 직원을 AI로 대체한다는 아이디어에 기뻐하면서 일부 CEO는 이제 자신도 도마 위에 서게 될 수 있다는 것을 두려워하기 시작했다.미국, 영국, 네덜란드의 수백 명의...

-

[MindPlex-암호화폐의 차세대 개척자: 레이어 3(L3) 네트워크] 블록체인 기능 잠금 해제: 레이어 3 네트워크를 탐색한다. 이러한 고급 솔루션이 어떻게 확장성, 상호 운용성 및 특수 기능을 향상시켜 암호화폐 발전의 다음 단계를 형성하는지 알아본다.중급 입문Web3 및 DeFi는 지속적으로 성장하고 성숙해지며, 확립된 모든 스마트 계약 플랫폼 블록체인은 사용자 요구에 부응하기 위해 확장성과 속도가 필요하므로 레이어 3 체인이라는 새로운 영...

[MindPlex-암호화폐의 차세대 개척자: 레이어 3(L3) 네트워크] 블록체인 기능 잠금 해제: 레이어 3 네트워크를 탐색한다. 이러한 고급 솔루션이 어떻게 확장성, 상호 운용성 및 특수 기능을 향상시켜 암호화폐 발전의 다음 단계를 형성하는지 알아본다.중급 입문Web3 및 DeFi는 지속적으로 성장하고 성숙해지며, 확립된 모든 스마트 계약 플랫폼 블록체인은 사용자 요구에 부응하기 위해 확장성과 속도가 필요하므로 레이어 3 체인이라는 새로운 영...

-

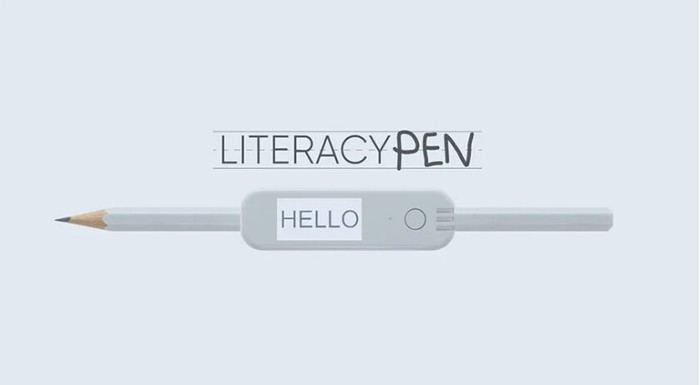

[인공지능, 음성 및 부드러운 억양으로 바꿔줘서 의사소통 능력 향상] 서로 다른 억양을 사용하면 의사소통 능력이 현저히 낮아진다. AI 기술을 사용하면 억양에 내재된 정체성을 제거하지 않으면서 공통 언어의 중간 지점을 향해 말을 부드럽게 해준다. 이는 상호 이해성을 향상시켜 보다 명확한 의사소통을 촉진하는 동시에 자신의 유산의 본질을 보존해 준다.우리는 인간의 문화와 언어의 다양성이 수렴되는 세상에 살고 있지만, 인간의 근본적인 과제는 여전히 남아 있다. 즉, 전 세계의 악센트를 넘나들며 의사소통하려는 투쟁이다.우리 사회에서는 세...

[인공지능, 음성 및 부드러운 억양으로 바꿔줘서 의사소통 능력 향상] 서로 다른 억양을 사용하면 의사소통 능력이 현저히 낮아진다. AI 기술을 사용하면 억양에 내재된 정체성을 제거하지 않으면서 공통 언어의 중간 지점을 향해 말을 부드럽게 해준다. 이는 상호 이해성을 향상시켜 보다 명확한 의사소통을 촉진하는 동시에 자신의 유산의 본질을 보존해 준다.우리는 인간의 문화와 언어의 다양성이 수렴되는 세상에 살고 있지만, 인간의 근본적인 과제는 여전히 남아 있다. 즉, 전 세계의 악센트를 넘나들며 의사소통하려는 투쟁이다.우리 사회에서는 세...

-

[AGI는 인공지능 신이다.] AI 기업들이 신을 건설하려고 노력하고 있다고 AI 업계의 챔피언이 주장하고 있다.AI신론자유럽에서 가장 유망한 새로운 AI 회사의 CEO는 소위 "일반 인공지능(AGI)"에 대한 탐구에 대해 반대 입장을 밝혔다. 그는 이것이 신을 창조하려는 욕구와 유사하다고 말한다.AI 회사...

[AGI는 인공지능 신이다.] AI 기업들이 신을 건설하려고 노력하고 있다고 AI 업계의 챔피언이 주장하고 있다.AI신론자유럽에서 가장 유망한 새로운 AI 회사의 CEO는 소위 "일반 인공지능(AGI)"에 대한 탐구에 대해 반대 입장을 밝혔다. 그는 이것이 신을 창조하려는 욕구와 유사하다고 말한다.AI 회사...

-

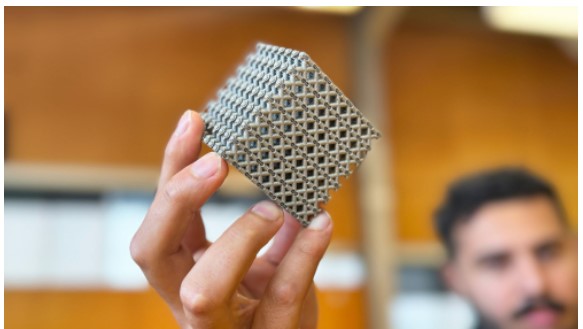

[3D프린팅 된 메타물질]자연의 어떤 것보다 강한 메타물질이 등장했다. 레이저와 금속 분말을 사용하여 호주 과학자들은 초강력, 초경량의 새로운 메타물질을 만들었다. 이는 항공우주에 사용되는 동급 소재보다 50% 더 강하다. 그러나 공상 과학처럼 들리는 이 창조물에 대한 아이디어는 식물에서 얻었다.과제: 탄소 섬유 및 그래핀과 같이 강하면서도 가벼운 소재는 의료용 임플란트부터 비행선까지 모든 것을 만드는 데 사용되며, "무게 대비 강도 비율"이 훨씬 더 높은 소재를 개발하는 것이...

[3D프린팅 된 메타물질]자연의 어떤 것보다 강한 메타물질이 등장했다. 레이저와 금속 분말을 사용하여 호주 과학자들은 초강력, 초경량의 새로운 메타물질을 만들었다. 이는 항공우주에 사용되는 동급 소재보다 50% 더 강하다. 그러나 공상 과학처럼 들리는 이 창조물에 대한 아이디어는 식물에서 얻었다.과제: 탄소 섬유 및 그래핀과 같이 강하면서도 가벼운 소재는 의료용 임플란트부터 비행선까지 모든 것을 만드는 데 사용되며, "무게 대비 강도 비율"이 훨씬 더 높은 소재를 개발하는 것이...

-

[유전자 하나를 끄면 쥐 다리가 6개 자라난다.] 척추 발달에 대한 연구는 이상한 방향으로 나아가 놀라운 발견을 했다. 척추를 연구하려는 시도에서 포르투갈의 과학자들은 생식기가 있어야 할 뒷다리 쌍이 추가로 있는 쥐 배아를 실수로 만들었다. 이상한 사건의 전환은 인간 배아 발달, 전이성 암 등에 대한 우리의 이해를 향상시킬 수 있다. 새로운 소식: 우리는 자궁에서 무슨 일이 일어나는지, 즉 단일 세포가 어떻게 완전히 새로운 유기체가 되는지에 대해 아직도 이해하지 못하는 것이 많다.이 수수께끼를 풀기 위해 포르투갈 굴벤키...

[유전자 하나를 끄면 쥐 다리가 6개 자라난다.] 척추 발달에 대한 연구는 이상한 방향으로 나아가 놀라운 발견을 했다. 척추를 연구하려는 시도에서 포르투갈의 과학자들은 생식기가 있어야 할 뒷다리 쌍이 추가로 있는 쥐 배아를 실수로 만들었다. 이상한 사건의 전환은 인간 배아 발달, 전이성 암 등에 대한 우리의 이해를 향상시킬 수 있다. 새로운 소식: 우리는 자궁에서 무슨 일이 일어나는지, 즉 단일 세포가 어떻게 완전히 새로운 유기체가 되는지에 대해 아직도 이해하지 못하는 것이 많다.이 수수께끼를 풀기 위해 포르투갈 굴벤키...

-

[MindPlex-2024년 비트코인 반감기: 4월 19일까지 최종 카운트다운] 2024년 비트코인 반감기 때문에 암호화폐 세계가 엄청난 변화에 대비하면서 기대감이 치솟고 있다. 역사는 반복될 것인가? 아니면 가치가 0으로 수렴할 것인가 지켜볼 문제이다.소개똑딱, 똑딱, 한 블록 더 가까이 다가간다. 중동 긴장 이후 이번 주말의 암호화폐 불안에도 불구하고 모든 사람과 그들의 고양이는 이제 2024년 4월 19일 오후 6시(UTC)로 예정된 이번 주 4차 비...

[MindPlex-2024년 비트코인 반감기: 4월 19일까지 최종 카운트다운] 2024년 비트코인 반감기 때문에 암호화폐 세계가 엄청난 변화에 대비하면서 기대감이 치솟고 있다. 역사는 반복될 것인가? 아니면 가치가 0으로 수렴할 것인가 지켜볼 문제이다.소개똑딱, 똑딱, 한 블록 더 가까이 다가간다. 중동 긴장 이후 이번 주말의 암호화폐 불안에도 불구하고 모든 사람과 그들의 고양이는 이제 2024년 4월 19일 오후 6시(UTC)로 예정된 이번 주 4차 비...

-

[새로운 광자 컴퓨터 칩, 빛을 사용하여 AI 에너지 비용 절감] AI 모델은 많은 에너지가 필요하며 전력문제가 심각하게 대두되고 있다. 전기 대신 빛을 사용하는 신경망 칩을 구축함으로 훨씬 적은 에너지 비용으로 AI 작업을 실행한다. 무려 에너지 소비를 1,000배 이상 줄일 수 있다.알고리즘이 성장하고 더욱 복잡해짐에 따라 현재 컴퓨터 칩에 점점 더 큰 부담을 주고 있다. 여러 회사에서 전력 소비를 줄이기 위해 AI에 맞춤화 된 칩을 설계했다. 하지만 그것들은 모두 하나의...

[새로운 광자 컴퓨터 칩, 빛을 사용하여 AI 에너지 비용 절감] AI 모델은 많은 에너지가 필요하며 전력문제가 심각하게 대두되고 있다. 전기 대신 빛을 사용하는 신경망 칩을 구축함으로 훨씬 적은 에너지 비용으로 AI 작업을 실행한다. 무려 에너지 소비를 1,000배 이상 줄일 수 있다.알고리즘이 성장하고 더욱 복잡해짐에 따라 현재 컴퓨터 칩에 점점 더 큰 부담을 주고 있다. 여러 회사에서 전력 소비를 줄이기 위해 AI에 맞춤화 된 칩을 설계했다. 하지만 그것들은 모두 하나의...

-

[BCI와 신경권] 우리의 마음은 온갖 종류의 영향으로 인해 타격을 받는다. BCI(뇌-컴퓨터 인터페이스)의 기술이 인간의 사고를 위협한다. 사람들이 일반적으로 자신의 신체와 재산에 대해 무엇을 할지 결정할 권리가 있는 것처럼, 모든 사람이 자신의 뇌 상태와 해당 정보에 접근할 수 있는 사람을 결정할 수 있는 기본 권리인 신경권(사고의 자유)을 보장받아야 한다. 고대 그리스 철학자 소크라테스는 결코 글을 쓰지 않았다. 그는 글쓰기가 기억을 약화시킨다고 경고했다. 그것은 단지 이전 생각을 상기시키는 것에 지나지 않다. 토론하고 논쟁하는 사람들에 비...

[BCI와 신경권] 우리의 마음은 온갖 종류의 영향으로 인해 타격을 받는다. BCI(뇌-컴퓨터 인터페이스)의 기술이 인간의 사고를 위협한다. 사람들이 일반적으로 자신의 신체와 재산에 대해 무엇을 할지 결정할 권리가 있는 것처럼, 모든 사람이 자신의 뇌 상태와 해당 정보에 접근할 수 있는 사람을 결정할 수 있는 기본 권리인 신경권(사고의 자유)을 보장받아야 한다. 고대 그리스 철학자 소크라테스는 결코 글을 쓰지 않았다. 그는 글쓰기가 기억을 약화시킨다고 경고했다. 그것은 단지 이전 생각을 상기시키는 것에 지나지 않다. 토론하고 논쟁하는 사람들에 비...

-

[챗봇 안전 테스트 개선을 위해 호기심 기반 AI 모델 개발] AI 챗봇의 책임감 있는 배포를 보장하려면 철저한 테스트와 보호 조치가 필수적이다. 연구원들은 머신러닝을 사용하여 레드팀 프로세스를 개선하는 혁신적인 접근 방식을 개발했다. 그들의 방법에는 테스트 중인 챗봇에서 더 넓은 범위의 바람직하지 않은 응답을 유발할 수 있는 다양한 프롬프트를 자동으로 생성하기 위해 별도의 레드팀 대규모 언어 모델을 훈련시키는 것이 포함된다.최근 몇 년 동안 LLM(대형 언어 모델)과 AI 챗봇이 엄청나게 널리 보급되어 기술과 상호 작용하는 방식이 바뀌었다. 이러한 정교한 시스템은 인간과 유사한 반응을 생성하고 다양한 작업을 지원하...

[챗봇 안전 테스트 개선을 위해 호기심 기반 AI 모델 개발] AI 챗봇의 책임감 있는 배포를 보장하려면 철저한 테스트와 보호 조치가 필수적이다. 연구원들은 머신러닝을 사용하여 레드팀 프로세스를 개선하는 혁신적인 접근 방식을 개발했다. 그들의 방법에는 테스트 중인 챗봇에서 더 넓은 범위의 바람직하지 않은 응답을 유발할 수 있는 다양한 프롬프트를 자동으로 생성하기 위해 별도의 레드팀 대규모 언어 모델을 훈련시키는 것이 포함된다.최근 몇 년 동안 LLM(대형 언어 모델)과 AI 챗봇이 엄청나게 널리 보급되어 기술과 상호 작용하는 방식이 바뀌었다. 이러한 정교한 시스템은 인간과 유사한 반응을 생성하고 다양한 작업을 지원하...

-

[MindPlex- 암호화폐와 블록체인에서 데이터 가용성(DA)이 중요] 데이터 가용성은 블록체인기술의 기본 측면이다. 그것이 없으면 우리는 분산 시스템의 무결성, 보안 및 기능을 신뢰할 수 없다. 확장성과 효율성에 대한 요구가 증가함에 따라 데이터 가용성과 관련된 고유한 문제를 해결하기 위해 롤업, 샤딩, 데이터 가용성 샘플링 및 전용 데이터 가용성 레이어와 같은 혁신적인 솔루션이 개발되고 있다. 향후 몇 년 동안 DA를 위한 최고의 블록체인이 번성할 가능성이 높다.소개Web2이든 Web3이든 디지털 세계는 데이터에 의해 주도된다. 암호화폐와 블록체인 부문에서도 다르지 않다. 거대하고 새로운 분산형 네트워크가 회전하고 새로운 체인 계층을 얻고 있으며 데이...

[MindPlex- 암호화폐와 블록체인에서 데이터 가용성(DA)이 중요] 데이터 가용성은 블록체인기술의 기본 측면이다. 그것이 없으면 우리는 분산 시스템의 무결성, 보안 및 기능을 신뢰할 수 없다. 확장성과 효율성에 대한 요구가 증가함에 따라 데이터 가용성과 관련된 고유한 문제를 해결하기 위해 롤업, 샤딩, 데이터 가용성 샘플링 및 전용 데이터 가용성 레이어와 같은 혁신적인 솔루션이 개발되고 있다. 향후 몇 년 동안 DA를 위한 최고의 블록체인이 번성할 가능성이 높다.소개Web2이든 Web3이든 디지털 세계는 데이터에 의해 주도된다. 암호화폐와 블록체인 부문에서도 다르지 않다. 거대하고 새로운 분산형 네트워크가 회전하고 새로운 체인 계층을 얻고 있으며 데이...

(사)유엔미래포럼이란?

- [투표의 미래 SIV: 안전한 인터넷투표 한국지사 찾아. 빠르고 사적이며 증명할 수 있는 SIV 인터넷 투표] 컴퓨터는 아날로그 옵션보다 훨씬 강력한 보안에 사용될 수 있으며 이미 정치적, 군사 및 경제 인프라의 많은 부분을 차지할 수 있다. 수백만 명의 미국인들이 온라인 은행을 채택했으며, 하루 만에 나스닥 증권 거래소는 수억 달러의 거래량을 보고 있다. 휴대폰으로 투표할 수 있는 미래가 온다. SIV는 온라인 유권자 검증 가능한 선거 시스템을 제공하여 정확성 또는 부패의 증거를 제공하며 모든 시민이 쉽게 접근할 수 있다. https://siv.org/ 유권자가 "예"를 확정한 경우:●타임 스탬프와 함께 데이터베이스에 정보를 저장한다.●원래 투표 확인 페이지를 업데이트하여 "1 개의 별도 장치로 확인됨 -Phen -iOS 15.3, Safari 11.3으로"표시된다.●유권자가 SM

- [10억 공모전 Deep Funding: 분산형 AI 서비스 개발 및 사용 자금 조달] Deep Funding은 분산되고 유익한 AI 서비스 네트워크를 구축하고 있다. Deep Funding을 통해 자금을 지원받아 AI 서비스를 개발하고 SingularityNET 플랫폼에 게시한다. 모델의 소유권을 유지하고 지적 재산으로 수익을 창출하며 분산형 AI의 글로벌 생태계 구축에 기여할 수 있다. 프로젝트 및 제안Deep Funding은 프로젝트를 정기적인 라운드로 구성한다. 참가자는 현재 라운드에 대한 제안서를 제출할 수 있으며, 이는 결국 커뮤니티에서 투표하여 자금을 받게 된다. 자금이 지원된 프로젝트도 확인할 수 있

- [Deep Funding: 분산형 AI 서비스 개발 및 사용 자금 조달] Deep Funding은 분산되고 유익한 AI 서비스 네트워크를 구축하고 있다. Deep Funding을 통해 자금을 지원받아 AI 서비스를 개발하고 SingularityNET 플랫폼에 게시한다. 모델의 소유권을 유지하고 지적 재산으로 수익을 창출하며 분산형 AI의 글로벌 생태계 구축에 기여할 수 있다. 프로젝트 및 제안Deep Funding은 프로젝트를 정기적인 라운드로 구성한다. 참가자는 현재 라운드에 대한 제안서를 제출할 수 있으며, 이는 결국 커뮤니티에서 투표하여 자금을 받게 된다. 자금이 지원된 프로젝트도 확인할 수 있다

| 주요뉴스 |

- [인공지능: 마음 읽기의 미래] 지난 몇 년 동안 AI 개발은 겉보기에 극복할 수 없을 것 같은 장애물을 뛰어넘는 경향을 보여왔다. 따라서 AI 기반 마음 읽기의 가능성을 완전히 배제하는 것은 현명하지 않다. 그러나 우리 정신 생활의 복잡성과 뇌에 대해 우리가 아는 바가 거의 없다는 점을 고려할 때(결국 신경 과학은 아직 초기 단계에 있음) AI 기반 마음 읽기에 대한 확실한 예측은 소금 한 알씩 받아들여야 한다.

- 올해 초 뉴럴링크(Neuralink)는 어깨 아래가 마비된 29세 미국 남성 놀랜드 아보(Noland Arbaugh)의 뇌 내부에 칩을 이식했다. 이 칩을 사용하면 아보가 마우스 포인터가 움직이는 것을 상상하는 것만으로 화면에서 마우스 포인터를 움...

- [AI 일자리 위기, 다음은 CEO 차례다] 인공지능이 일반 직원을 일자리 위기에 빠뜨리고 있는 가운데기업들의 주요 사안의 결정권자인 CEO들이 ChatGPT를 사용하여 얻은 데이터와 정보를 기반으로 비밀리에 중요한 비즈니스 결정을 내리고 있다. 그들이 기술로 무엇을 결정하고 무엇을 하는지 잘 지켜봐야 한다.

- 비즈니스 역류많은 CEO가 인간 직원을 AI로 대체한다는 아이디어에 기뻐하면서 일부 CEO는 이제 자신도 도마 위에 서게 될 수 있다는 것을 두려워하기 시작했다.미국, 영국, 네덜란드의 수백 명의 비즈니스 리더를 대상으로 한...

- [인공지능, 음성 및 부드러운 억양으로 바꿔줘서 의사소통 능력 향상] 서로 다른 억양을 사용하면 의사소통 능력이 현저히 낮아진다. AI 기술을 사용하면 억양에 내재된 정체성을 제거하지 않으면서 공통 언어의 중간 지점을 향해 말을 부드럽게 해준다. 이는 상호 이해성을 향상시켜 보다 명확한 의사소통을 촉진하는 동시에 자신의 유산의 본질을 보존해 준다.

- 우리는 인간의 문화와 언어의 다양성이 수렴되는 세상에 살고 있지만, 인간의 근본적인 과제는 여전히 남아 있다. 즉, 전 세계의 악센트를 넘나들며 의사소통하려는 투쟁이다.우리 사회에서는 세계 각지에서 온 사람들이 서로...

- [유전자 하나를 끄면 쥐 다리가 6개 자라난다.] 척추 발달에 대한 연구는 이상한 방향으로 나아가 놀라운 발견을 했다. 척추를 연구하려는 시도에서 포르투갈의 과학자들은 생식기가 있어야 할 뒷다리 쌍이 추가로 있는 쥐 배아를 실수로 만들었다. 이상한 사건의 전환은 인간 배아 발달, 전이성 암 등에 대한 우리의 이해를 향상시킬 수 있다.

- 새로운 소식: 우리는 자궁에서 무슨 일이 일어나는지, 즉 단일 세포가 어떻게 완전히 새로운 유기체가 되는지에 대해 아직도 이해하지 못하는 것이 많다.이 수수께끼를 풀기 위해 포르투갈 굴벤키안 과학 연구소(Gulbenkian Science...

- [BCI와 신경권] 우리의 마음은 온갖 종류의 영향으로 인해 타격을 받는다. BCI(뇌-컴퓨터 인터페이스)의 기술이 인간의 사고를 위협한다. 사람들이 일반적으로 자신의 신체와 재산에 대해 무엇을 할지 결정할 권리가 있는 것처럼, 모든 사람이 자신의 뇌 상태와 해당 정보에 접근할 수 있는 사람을 결정할 수 있는 기본 권리인 신경권(사고의 자유)을 보장받아야 한다.

- 고대 그리스 철학자 소크라테스는 결코 글을 쓰지 않았다. 그는 글쓰기가 기억을 약화시킨다고 경고했다. 그것은 단지 이전 생각을 상기시키는 것에 지나지 않다. 토론하고 논쟁하는 사람들에 비해 독자들은 “많은 것을 듣는...

- [챗봇 안전 테스트 개선을 위해 호기심 기반 AI 모델 개발] AI 챗봇의 책임감 있는 배포를 보장하려면 철저한 테스트와 보호 조치가 필수적이다. 연구원들은 머신러닝을 사용하여 레드팀 프로세스를 개선하는 혁신적인 접근 방식을 개발했다. 그들의 방법에는 테스트 중인 챗봇에서 더 넓은 범위의 바람직하지 않은 응답을 유발할 수 있는 다양한 프롬프트를 자동으로 생성하기 위해 별도의 레드팀 대규모 언어 모델을 훈련시키는 것이 포함된다.

- 최근 몇 년 동안 LLM(대형 언어 모델)과 AI 챗봇이 엄청나게 널리 보급되어 기술과 상호 작용하는 방식이 바뀌었다. 이러한 정교한 시스템은 인간과 유사한 반응을 생성하고 다양한 작업을 지원하며 귀중한 통찰력을 제공할 수...

- [MindPlex- 암호화폐와 블록체인에서 데이터 가용성(DA)이 중요] 데이터 가용성은 블록체인기술의 기본 측면이다. 그것이 없으면 우리는 분산 시스템의 무결성, 보안 및 기능을 신뢰할 수 없다. 확장성과 효율성에 대한 요구가 증가함에 따라 데이터 가용성과 관련된 고유한 문제를 해결하기 위해 롤업, 샤딩, 데이터 가용성 샘플링 및 전용 데이터 가용성 레이어와 같은 혁신적인 솔루션이 개발되고 있다. 향후 몇 년 동안 DA를 위한 최고의 블록체인이 번성할 가능성이 높다.

- 소개Web2이든 Web3이든 디지털 세계는 데이터에 의해 주도된다. 암호화폐와 블록체인 부문에서도 다르지 않다. 거대하고 새로운 분산형 네트워크가 회전하고 새로운 체인 계층을 얻고 있으며 데이터 가용성은 무결성, 보안 및 ...

- [디지털 혁신의 쓰나미가 제품 개발을 강타하고 있다. 파도에 올라타거나, 압도당하거나] 메트릭스 영화가 점점 현실이 되어 가고 있다. 실시간보다 빠른 데이터의 풍부한 소스를 통해 AI는 곧 많은 물리적 산업을 조종하는 방법을 배우게 된다. 그 결과는 매트릭스의 디스토피아도 아니고 기술 산업 판타지의 유토피아도 아닐 수도 있다. 우리는 컴퓨터 프로그램 안에 있게 될 지도 모른다.

- 1999년 SF 영화 매트릭스는 현실과 가상의 경계를 모호하게 만들었다. 25년이 채 지나지 않아 AI와 디지털 시뮬레이션의 극적인 발전은 기술 자체가 생성되고 사용되는 방식을 혼란에 빠뜨리고 있다. 오늘날 기업은 매트릭스와 ...

- [로봇이 현실 세계를 탐색하는 데 도움을 주는 '홀로데크Holodeck'] 사용자는 일상적인 언어를 사용하여 홀로데크(Holodeck)에서 가상으로 무한한 다양한 3D 공간을 생성하도록 유도할 수 있으며 수백만 또는 수십억 개의 시뮬레이션 환경을 만든다. 이는 훈련 로봇이 세계를 탐색할 수 있는 새로운 가능성을 창출한다.

- (이미지 제공: Yue Yang)가상 대화형 환경은 현재 "Sim2Real"이라는 프로세스를 통해 실제 배포에 앞서 로봇을 훈련하는 데 사용된다. 그러나 예술가들이 만들어낸 이러한 복잡한 환경은 공급이 부족하다."ChatGPT와 같은 생...

- [2024년 마케팅 분야 AI의 현황] 마케팅에 AI를 사용하면 기업이 고객과 소통하는 방식이 바뀌었다. 개인화된 클라이언트 경험을 제공하고 반복적인 작업을 자동화할 수 있다. McKinsey 연구에 따르면 AI 사용 사례의 가치 중 약 75%가 네 가지 영역에 걸쳐 제공될 수 있으며 마케팅도 그중 하나이다.

- 인공지능(AI) 마케팅 규모는 2032년까지 1,454억 2천만 달러에 이를 것으로 예상된다.마케팅에 상당한 결과를 제공할 수 있는 AI의 잠재력에도 불구하고 마케팅 담당자는 이 기술을 완전히 채택하는 것을 주저하고 있다. 따라서...

- [AI 환각을 멈춰야 한다: 허위 정보를 만드는 것은 AI의 가장 큰 문제 중 하나이지만 만능 해결책은 없다] AI가 의료부터 금융, 미디어에 이르기까지 다양한 분야에서 점점 더 중요한 역할을 하고 있기 때문에 위험이 높다. 이에 연구자들은 사실과 허구를 구별하도록 AI 시스템을 훈련시키기 위해 검증된 정보의 대규모 데이터 세트를 사용하는 것을 포함하여 환각 문제를 해결하기 위한 다양한 접근 방식을 모색하고 있다.

- AI가 계속 발전하면서 한 가지 큰 문제가 등장했다. 바로 '환각'이다. 이는 실제로 근거가 없는 AI가 생성한 출력이다. 환각은 작은 실수부터 완전히 기괴하고 꾸며낸 정보까지 무엇이든 될 수 있다. 이 문제는 많은 사람들이 ...

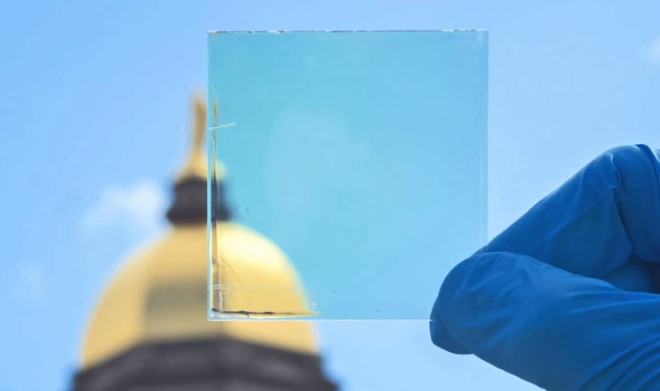

- [투명 망토, 필요에 따라 속성을 바꾸는 프로그래밍 가능 액체]하버드 팀이 개발한 메타물질로 알려진 물질은 구성이 아닌 구조적 구성에 따라 특성이 결정되도록 세심하게 설계되었다. 일부 메타물질은 장거리 무선 전력 전송을 실용화할 수 있고, 다른 물질은 투명 망토 또는 뇌파에 반응하는 미래형 물질을 가져올 수 있다.

- 우리는 남은 음식을 감쌀 수 있는 금속 합금 메뉴, 상상할 수 있는 모든 색상의 페인트, 끊임없이 변화하는 디지털 디스플레이 등 독창적인 물질로 둘러싸여 있다. 사실상 이들 모두는 기본 재료의 자연적 특성을 활용한다.그러...

- [AI가 고객 충성도를 향상시킨다] 오늘날 경쟁이 치열한 비즈니스 환경에서 고객 충성도를 높이는 데 있어 인공지능의 역할은 그 어느 때보다 중요하다. AI는 브랜드가 고객과 상호 작용하는 방식을 재정의하는 선두에 서 있다. 일상적인 프로세스에 기술을 통합하는 것은 더욱 강력하고 오래 지속되는 관계를 구축하려는 기업에게 전략적 필수 요소가 되었다.

- 충성고객의 가치고객 충성도는 사람들이 경쟁사에 비해 동일한 브랜드를 얼마나 자주 후원하는지를 측정한다. 과거에는 소비자들이 주로 근처에 있는 기업에 충성도를 보였다. 그러나 물리적 위치는 더 이상 장벽이 아니며 선...

- 비디오 책[AI 향상 소프트웨어 CEO, AI와 인간 창의성 간의 협력 강조] Topaz Labs의 CEO인 Eric Yang은 AI가 인간의 창의성을 대체할 것이라는 생각을 일축하며 AI가 인간을 대체할 것이라는 일반적인 두려움이 있지만 우리는 대신 AI가 지원하는 인간의 창의성과 생산성이 폭발적으로 증가할 것이라고 믿는다.

- [중국, 올해도 최대 규모의 백만장자 대이동 목격] 투자이민 컨설팅회사인 Henley & Partners는 중국이 다른 어떤 국가보다 이민으로 인해 가장 많은 백만장자를 잃을 것으로 예상된다고 보고했다. 2022년에 10,800명의 고액 자산가가 중국을 떠났고 올해 추가로 13,500명이 떠날 것으로 예상된다

- [Enveda Biosciences, 자연의 화학 코드 잠금을 해제하는 새로운 AI 알고리즘 공개] 천연 자원에서 새로운 의약품을 발견하는 생명공학 회사인 엔베다 바이오사이언스(Enveda Biosciences)가 자사의 기본 AI 모델 중 하나인 MS2Mol의 세부 정보를 ChemRxiv에 게시된 사전 인쇄에서 공개했다.

- [피터디아만디스- AI는 개방형이여야 할까? 아니면 폐쇄형이어야 할까?] AI가 한사람 한국가의 손에 들어가면 그들이 세상을 지배할 수있다. AI는 모든 산업을 완전히 변화시키고, 새로운 세계 질서를 주도하고, 차세대 조만장자를 창출할 수 있는 힘을 가지고 있고 세계 최대의 문제를 해결하기 위해 우리가 만든 가장 중요한 단일 도구이기 때문에 소수기업에 집중이 되면 안된다. 민주화가 되어 전 세계 더 많은 사람들이 접근할 수 있어야 한다.

- [ChatGPT가 금융 분야로 진출한다] 이제 판도라의 상자가 열렸으니 되돌릴 수 없다. 우리는 생성 AI와 LLM이 금융 부문에서 더 중요한 역할을 하는 것을 보게 될 것이며, 투자 전문가들이 신속한 엔지니어링과 상황 분석을 강조하는 새로운 직책으로 이동하게 된다. 변경이 불가피하므로 논리적인 다음 단계는 시스템을 디버그하는 것이다. 말하자면 잠재적인 위험을 살펴보고 이를 완화하는 방법을 고려하는 것이다.

- [글, 소설 잘쓰는 AI앱, 영어 회화 앱 15개] 글, 소설 잘 쓰게 도와주는 어플들: Reedsy Book Editor, Scrivener, Ulysses, Plottr, iA Writer, Grammarly, Final Draft, ProWritingAid , Storyist, , yWriter, ,

- [생성 AI 가치 사슬에서 기회 탐색] 생성 AI 기술이 진화하고 새로운 사용 사례가 시장에 등장하는 엄청난 속도로 인해 투자자와 비즈니스 리더는 생성 AI 에코시스템을 이해하기 위해 안간힘을 쓰고 있다. CEO 전략과 이 기술이 산업 전반에 걸쳐 전 세계적으로 창출할 수 있는 잠재적인 경제적 가치에 대해 자세히 알아보는 동안 여기에서는 생성 AI 가치 사슬 구성을 살펴본다.

- [여행사 소멸, ChatGPT가 여행 계획 짜준다] OpenAI는 11개 회사에서 만든 플러그인을 출시한다고 발표했다. ChatGPT Plus 사용자는 이러한 플러그인을 사용하여 실시간 정보를 위해 인터넷에 액세스하는 기능과 같은 새로운 기능을 얻을 수 있다. 온라인 여행사 Expedia는 ChatGPT 플러그인을 개발한 최초의 회사 중 하나였으며 이제 ChatGPT가 완벽한 휴가 계획을 도와준다. AI는 Expedia 앱에서 바로 호텔, 레스토랑 등을 추천할 수 있다.

- [챗GPT: AI 질문하기] 세계최초 "AI질문하기 교육" 실시. 유엔미래포럼 3월 25일 토요일 오후1-6시 챗GPT에 세계최초 AI질문대회: 챗GPT에 질문잘 하는 방법, AI도구와 어플 50여가지 배워. AI가 그림그리고, 비디오제작편집, 음악 노래만들기, 홈피만들기 등 그외 그레이스로봇과 대화하기: 교육 6시간 3월 25일 토 첫 개강

- [ChatGPT4 답변. 미래학자가 본 사이비종교나 이단의 미래? 미래의 사이비종교 등이 줄어드는 이유, 그리고 기술발전 즉 드론, 칩, IOT 센서등으로 종교들의 비밀집회나 집단생활에 대한 감시자 정찰이 손쉬워 지면서 사이비, 이단이 설 땅이 줄어든다. 세금면제가 줄어들면서 노동착취나 성착취등도 쉽게 행할 수 없는 상황이 되면서, 집단생활도 줄어든다.

- [GPT-4] OpenAI는 GPT-4가 거의 모든 면에서 더 낫다고 말한다. 알고리즘의 출력이 이전 버전보다 더 높은 품질, 더 정확하고 기괴하거나 유독한 폭발이 덜 발생한다. 더 중요한 것은 수백만 명이 사용할 것이라는 점이다.

- [ChatGPT가 로봇을 제어] Microsoft 덕분에 새로운 API를 통해 ChatGPT는 자연어 처리로 로봇을 제어할 수 있다. Microsoft는 이 혁명의 최전선에서 로봇과 자연스럽고 인간과 같은 방식으로 통신할 수 있는 새로운 API를 개발했다. ChatGPT API는 머신러닝 기술을 기반으로 한다. 즉, 자연어를 이해하고 그에 따라 응답할 수 있다. 이것은 매우 다양하고 광범위한 응용 분야에 적합하다.

- [하이퍼클로바x] 'Chat GPT 6500 times learning Korean'... Naver to unveil HyperClova X in July 네이버가 오는 7월에 초대규모 AI ‘하이퍼클로바X’를 공개한다. 챗GPT보다 한국어를 6500배 더 많이 학습했다. 네이버는 누구나 자신이 보유한 데이터를 초대규모 AI에서 활용할 수 있도록 지원

- [ChatGPT-역사] ChatGPT는 당신의 인생을 바꾸게 된다. 역사는 당신의 두뇌가 준비되어 있음을 알려준다. 인간은 항상 새로운 기술에 적응해 왔다. 문자를 발명한 메소포타미아인들에게 물어보라. 우리가 과거에 변화하는 기술에 어떻게 적응했는지 알면 인간의 상태를 더 완전히 이해하고 미래를 준비하는 데 도움이 될 수도 있다.

- [제너레이티브 AI란? AI가 설명한다] 제너레이티브 AI는 학습된 데이터를 기반으로 새로운 출력을 생성하는 인공지능(AI) 알고리즘 범주를 나타낸다. 패턴을 인식하고 예측하도록 설계된 기존 AI 시스템과 달리 생성 AI는 이미지, 텍스트, 오디오 등의 형태로 새로운 콘텐츠를 생성한다.

전체: 437,780

오늘: 298

어제: 467

오늘: 298

어제: 467

|

- [빅테크 기업이 생성AI를 다 잡아먹는다] 빅 테크 기업이 막대한 투자금을 생성 AI를 선도하는데 쏟아 붇고 있다. 그들의 막대한 자원은 AI 연구 및 응용 프로그램을 가속화할 수 있지만 한편으로 독점 제어의 가능성은 부인할 수 없다.

-

[ChatGPT의 답변] 늘 의문을 가졌던 분야인데, 해외에서 거주하던 본인으로서 왜 한국의 집값이 이렇게 비싼지, 비교해 본 정보가 있는지 물었다. 한국인들만 특별히 주택 또는 아파트소유에 집착하는 이유를 알고 싶었다. 특히 한국인 주택소유통계결과를 보면 86.5%가 주택을 소유하고 있는데, 이는 지속적으로 증가하고 있다. 서구의 주택소유통계는 얼마일까?

[ChatGPT의 답변] 늘 의문을 가졌던 분야인데, 해외에서 거주하던 본인으로서 왜 한국의 집값이 이렇게 비싼지, 비교해 본 정보가 있는지 물었다. 한국인들만 특별히 주택 또는 아파트소유에 집착하는 이유를 알고 싶었다. 특히 한국인 주택소유통계결과를 보면 86.5%가 주택을 소유하고 있는데, 이는 지속적으로 증가하고 있다. 서구의 주택소유통계는 얼마일까?

[미국법원에 출두한 최초의 AI변호사] 인공지능(AI)이 과속 딱지로부터 방어하는 데 도움이 될 때 전체 미국법원 절차 전반에 걸쳐 이러한 종류의 첫 번째 법원출두 AI변호사 사례가 된다. DoNotPay의 창업자 브라우더는 내 목표는 2000억 달러 규모의 법조계를 소비자에게 무료로 제공하는 것이다."라고 홍보비디오에서 Mr. Browder는 말한다.

[미국법원에 출두한 최초의 AI변호사] 인공지능(AI)이 과속 딱지로부터 방어하는 데 도움이 될 때 전체 미국법원 절차 전반에 걸쳐 이러한 종류의 첫 번째 법원출두 AI변호사 사례가 된다. DoNotPay의 창업자 브라우더는 내 목표는 2000억 달러 규모의 법조계를 소비자에게 무료로 제공하는 것이다."라고 홍보비디오에서 Mr. Browder는 말한다.

[9. 볼펜판매로 번 돈으로 경구 피임약을 개발] 여성이 피임을 하면서 여대생 비율이 남성을 능가했다. (분란의 패턴, 9부) 피임 알약은 평등권, 낙태합법화에 대한 Roe v. Wade 대법원 사건에서 중요한 역할을 했다. 그것은 아이들의 수를 극적으로 변화시켰다. 소개된 지 약 10년이 지난 지금, 미국에서 가장 많은 사람들이 '4명 이상의' 자녀를, '0에서 2'를 원한다고 보고했다. Milton Reynolds가 볼펜으로 번 돈은 피임약을 탄생시켰고 그렇게 함으로써 펜을 원하는 사람들의 수를 극적으로 증가시켰다.

[9. 볼펜판매로 번 돈으로 경구 피임약을 개발] 여성이 피임을 하면서 여대생 비율이 남성을 능가했다. (분란의 패턴, 9부) 피임 알약은 평등권, 낙태합법화에 대한 Roe v. Wade 대법원 사건에서 중요한 역할을 했다. 그것은 아이들의 수를 극적으로 변화시켰다. 소개된 지 약 10년이 지난 지금, 미국에서 가장 많은 사람들이 '4명 이상의' 자녀를, '0에서 2'를 원한다고 보고했다. Milton Reynolds가 볼펜으로 번 돈은 피임약을 탄생시켰고 그렇게 함으로써 펜을 원하는 사람들의 수를 극적으로 증가시켰다.

- [빅테크 기업이 생성AI를 다 잡아먹는다] 빅 테크 기업이 막대한 투자금을 생성 AI를 선도하는데 쏟아 붇고 있다. 그들의 막대한 자원은 AI 연구 및 응용 프로그램을 가속화할 수 있지만 한편으로 독점 제어의 가능성은 부인할 수 없다.

-

[ChatGPT의 답변] 늘 의문을 가졌던 분야인데, 해외에서 거주하던 본인으로서 왜 한국의 집값이 이렇게 비싼지, 비교해 본 정보가 있는지 물었다. 한국인들만 특별히 주택 또는 아파트소유에 집착하는 이유를 알고 싶었다. 특히 한국인 주택소유통계결과를 보면 86.5%가 주택을 소유하고 있는데, 이는 지속적으로 증가하고 있다. 서구의 주택소유통계는 얼마일까?

[ChatGPT의 답변] 늘 의문을 가졌던 분야인데, 해외에서 거주하던 본인으로서 왜 한국의 집값이 이렇게 비싼지, 비교해 본 정보가 있는지 물었다. 한국인들만 특별히 주택 또는 아파트소유에 집착하는 이유를 알고 싶었다. 특히 한국인 주택소유통계결과를 보면 86.5%가 주택을 소유하고 있는데, 이는 지속적으로 증가하고 있다. 서구의 주택소유통계는 얼마일까?

[미국법원에 출두한 최초의 AI변호사] 인공지능(AI)이 과속 딱지로부터 방어하는 데 도움이 될 때 전체 미국법원 절차 전반에 걸쳐 이러한 종류의 첫 번째 법원출두 AI변호사 사례가 된다. DoNotPay의 창업자 브라우더는 내 목표는 2000억 달러 규모의 법조계를 소비자에게 무료로 제공하는 것이다."라고 홍보비디오에서 Mr. Browder는 말한다.

[미국법원에 출두한 최초의 AI변호사] 인공지능(AI)이 과속 딱지로부터 방어하는 데 도움이 될 때 전체 미국법원 절차 전반에 걸쳐 이러한 종류의 첫 번째 법원출두 AI변호사 사례가 된다. DoNotPay의 창업자 브라우더는 내 목표는 2000억 달러 규모의 법조계를 소비자에게 무료로 제공하는 것이다."라고 홍보비디오에서 Mr. Browder는 말한다.

[9. 볼펜판매로 번 돈으로 경구 피임약을 개발] 여성이 피임을 하면서 여대생 비율이 남성을 능가했다. (분란의 패턴, 9부) 피임 알약은 평등권, 낙태합법화에 대한 Roe v. Wade 대법원 사건에서 중요한 역할을 했다. 그것은 아이들의 수를 극적으로 변화시켰다. 소개된 지 약 10년이 지난 지금, 미국에서 가장 많은 사람들이 '4명 이상의' 자녀를, '0에서 2'를 원한다고 보고했다. Milton Reynolds가 볼펜으로 번 돈은 피임약을 탄생시켰고 그렇게 함으로써 펜을 원하는 사람들의 수를 극적으로 증가시켰다.

[9. 볼펜판매로 번 돈으로 경구 피임약을 개발] 여성이 피임을 하면서 여대생 비율이 남성을 능가했다. (분란의 패턴, 9부) 피임 알약은 평등권, 낙태합법화에 대한 Roe v. Wade 대법원 사건에서 중요한 역할을 했다. 그것은 아이들의 수를 극적으로 변화시켰다. 소개된 지 약 10년이 지난 지금, 미국에서 가장 많은 사람들이 '4명 이상의' 자녀를, '0에서 2'를 원한다고 보고했다. Milton Reynolds가 볼펜으로 번 돈은 피임약을 탄생시켰고 그렇게 함으로써 펜을 원하는 사람들의 수를 극적으로 증가시켰다.

[8. 만년필은 잉크가 새는데 볼펜을 만들어 갑부가된 레이놀즈는 피임약을 만들고, 인구팽창을 막았다.파괴의 패턴 8. 1931년 부다페스트 국제박람회에서 새지 않는 볼펜을 선보였다. 이전 볼펜과 달리 Bíró 모델은 당시의 펜 잉크보다 점성이 높지만 빠르게 건조되는 신문 잉크를 사용하여 종이에 적용한 후 번지지 않았다.

[8. 만년필은 잉크가 새는데 볼펜을 만들어 갑부가된 레이놀즈는 피임약을 만들고, 인구팽창을 막았다.파괴의 패턴 8. 1931년 부다페스트 국제박람회에서 새지 않는 볼펜을 선보였다. 이전 볼펜과 달리 Bíró 모델은 당시의 펜 잉크보다 점성이 높지만 빠르게 건조되는 신문 잉크를 사용하여 종이에 적용한 후 번지지 않았다.

[7. 비단 스타킹이 나일론 스타킹이 나와 소멸되고, 스타킹때문에 나일론이 양산되면서 칫솔이 개발, 구강 건강 혁명이 일어나](파괴 패턴, 7부). 나일론 양말이 실크 스타킹을 대체한 것처럼 빠르게 실크 치실을 대체했다.

[7. 비단 스타킹이 나일론 스타킹이 나와 소멸되고, 스타킹때문에 나일론이 양산되면서 칫솔이 개발, 구강 건강 혁명이 일어나](파괴 패턴, 7부). 나일론 양말이 실크 스타킹을 대체한 것처럼 빠르게 실크 치실을 대체했다.

[6. 선적 컨테이너 변화는 철강산업과 조선산업을 일으키고 그것이 기근 종식을 도왔다[ (붕괴의 패턴, 6부). 우리의 이야기는 1956년 4월 뉴저지주 포트 뉴어크에서 시작된다. 그곳에서 42세의 기업가 Malcom McLean은 개조된 유조선 Ideal-X 에 58개의 거대한 강철 선적 컨테이너를 실었다.

[6. 선적 컨테이너 변화는 철강산업과 조선산업을 일으키고 그것이 기근 종식을 도왔다[ (붕괴의 패턴, 6부). 우리의 이야기는 1956년 4월 뉴저지주 포트 뉴어크에서 시작된다. 그곳에서 42세의 기업가 Malcom McLean은 개조된 유조선 Ideal-X 에 58개의 거대한 강철 선적 컨테이너를 실었다.

[5. 다가오는 글로벌 비료 위기] 비료의 수질오염, 그리고 이를 해결하는 방법은 정밀발표 세포농업이다(파괴 패턴, 5부) 대부분의 역사에서 비료는 동물 배설물에서 얻었고, 더 최근에는 현재 칠레 북부에 해당하는 아타카마 사막에서 발견되는 것과 같은 천연 질산염 퇴적물을 채굴하여 얻었다. 그러나 1900년대 초반에 불과 몇 년 동안 우리가 질소를 얻는 방법은 극적인 변화를 겪었고 그 결과는 오늘날에도 여전하다.

[5. 다가오는 글로벌 비료 위기] 비료의 수질오염, 그리고 이를 해결하는 방법은 정밀발표 세포농업이다(파괴 패턴, 5부) 대부분의 역사에서 비료는 동물 배설물에서 얻었고, 더 최근에는 현재 칠레 북부에 해당하는 아타카마 사막에서 발견되는 것과 같은 천연 질산염 퇴적물을 채굴하여 얻었다. 그러나 1900년대 초반에 불과 몇 년 동안 우리가 질소를 얻는 방법은 극적인 변화를 겪었고 그 결과는 오늘날에도 여전하다.

[4.진짜 비건이 아닌 동물 비건을 만드는 방법] 정밀발효, 세포농업 및 식품 파괴. 오늘날 동물을 먹이는 데 필요한 총 면적은 약 33억 헥타르이다. 그런 관점에서 보자면 지구상의 거주 가능한 땅의 총 면적은 약 100억 헥타르에 불과하다.

[4.진짜 비건이 아닌 동물 비건을 만드는 방법] 정밀발효, 세포농업 및 식품 파괴. 오늘날 동물을 먹이는 데 필요한 총 면적은 약 33억 헥타르이다. 그런 관점에서 보자면 지구상의 거주 가능한 땅의 총 면적은 약 100억 헥타르에 불과하다.

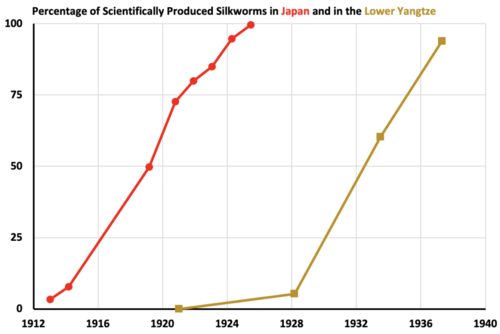

[3. 합성 산업이 천연 자원을 대체하고 세상을 변화시킨 방법] (파괴의 패턴, 3부) 인조 인디고는 천연 염료를 빠르게 대체했다. 독일 회사인 BASF는 최초의 합성 인디고를 상업적으로 생산할 수 있는 실행 가능한 경로를 찾았다. 이 제품은 처음에 우리가 신기술에서 발견한 패턴의 일부인 기존 업체의 회의론에 부딪혔다.

[3. 합성 산업이 천연 자원을 대체하고 세상을 변화시킨 방법] (파괴의 패턴, 3부) 인조 인디고는 천연 염료를 빠르게 대체했다. 독일 회사인 BASF는 최초의 합성 인디고를 상업적으로 생산할 수 있는 실행 가능한 경로를 찾았다. 이 제품은 처음에 우리가 신기술에서 발견한 패턴의 일부인 기존 업체의 회의론에 부딪혔다.

많이 본 기사

섹션별 주요뉴스